20 Inspiring Quotes About Buy A1 Certificate

페이지 정보

본문

Where to Buy an A1 Certificate

The certificate A1 defines the social security system that applies to those who are seconded abroad to work. This is a very important document, and failure to comply can result in serious consequences.

A Belgian inspection has launched criminal proceedings against a Slovak company that had posted workers without the A1 certificates required. A1 certificates have binding effects on the courts and institutions of the former Member States.

What is the a1 zertifikat kaufen erfahrungen Certificate?

The A1 certificate is an essential document for business travelers who travel throughout Europe. As employees move between countries, it's important for them to have this paperwork in order to avoid complications with the local social security systems.

This form identifies the country of residence of the employee (where the employee is legally registered and pays taxes) and their insurance company of choice. The A1 certificate clarifies this information and allows workers to avoid paying multiple premiums.

This form is usually requested by employers on behalf of employees by social contribution and health insurance authorities in the country. Each individual country has their specific template, so it is important to determine which one you need to apply for.

Typically typically, the A1 certificate is required when an employee is sent on assignment to another European country for a short - to medium-term duration. It is also helpful for business travelers traveling between EU and EFTA countries, Switzerland, and Denmark (still being used by British citizens, despite Brexit).

This isn't an immigration or work permit but it's an essential piece of documentation for many employees prior to their travel abroad. Since each European country has their own social security system, employees must ensure that their contributions go to the right place. A1 certificates can prove this.

It's essential for companies to get the proper paperwork in place so that they can ensure their employees are traveling and performing their duties in a timely manner. This is also important because certain countries have begun to impose penalties on those who don't have A1 certificates.

To be eligible to apply for an A1 You must be authorised in TWinternet, and you can make arrangements through your eHerkenning supplier. You can also update and access your authorisations on TWinternet via the self-service tool. It doesn't matter how you get your A1, you should always stay up to date with any changes. This will ensure that you adhere to all laws and regulations of every country.

How do I get an A1 Certificate

It can be a challenge to obtain an A1 certification, particularly when your company employs employees spread across Europe. Each country has its own rules and processes for obtaining the certificate, making it difficult to manage the process from one place. Localyze provides an integrated dashboard that can be used to monitor the process of applying for a certificate and the status of each employee. You can also find a comprehensive list of contact information for each European A1 certificate office of a country on the official EU website.

A1 certificates are required for business travel within the EU, EEA and Switzerland. Many employers are unaware that they're required to have them for certain types of work abroad. This means that non-compliant workers are likely to be caught off guard by inspections by social security and labor authorities, especially when they're traveling for a short period of time.

The A1 certificate is a document that proves the person is liable for taxes and social contributions in their home country. It's typically valid for a maximum of two years and includes both the home country and the host country. It's crucial to have this document because it ensures that the person isn't contributing to more than one system and will avoid fines and penalties for non-compliance.

This is also beneficial for employers who wish to make sure that their employees pay into the correct system when traveling for business or working. This helps to avoid situations where an employee accidentally contributes to more than one system, which can lead to expensive back payments and even tax fraud.

Whether you're traveling for work, studying abroad or simply visiting your relatives in another part of the world, having an A1 certification is crucial. It's a great way to demonstrate that you're in compliance with local laws. This is a good idea if you are employed in the EU or other countries that are part of the EFTA.

If you're unsure if you need an A1 certificate or need help with the process, don't hesitate to reach out to our team. We'll guide you through the process and ensure you're aware of the requirements for each country, so you're able to remain in compliance throughout your travels.

How Long Does It Take to Receive an A1 Certificate?

Depending on the country of origin, it can take anywhere from 15 to 45 days to get an A1 certificate. As a result, it is essential to plan ahead and start the process early. This will avoid any miscommunications or delays, and also ensures that the employee is protected for the entire time they are abroad.

The duration of an assignment abroad determines if an A1 certificate is required. However, other aspects can affect the procedure. For instance when a person has dual residency in the UK and another EU or EEA country then they must obtain an A1 certificate to prove that they are not required to pay social security taxes in both countries. A1 certificates are essential to this individual in order to avoid double payments or other compliance issues.

To avoid this, those with dual residence should apply for an A1 certification as soon as they begin working in the UK. It is essential that employees keep track of their time they spent in the UK. This includes travel and work schedules as well as records. This will help avoid potential problems if local authorities are unsure about the validity of their A1 certificate.

Businesses that send workers frequently to other countries can mitigate unnecessary risks by creating clear procedures and processes for A1 certificates. Furthermore, businesses must stay up-to-date with any changes to A1 requirements in light of the UK's withdrawal from the European Union or other changes in regulations.

A1 certificates can be a useful tool for UK employers and their employees who are on overseas assignments. By understanding the procedure, avoiding common mistakes, and leveraging technology, employers can streamline A1 application processes to improve efficiency and reduce compliance risks. For more details, read our A1 Certificate Cheat Sheet for additional tips, common challenges and solutions.

A1 certificates can be a useful tool for UK employers and their employees who are on overseas assignments. By understanding the procedure, avoiding common mistakes, and leveraging technology, employers can streamline A1 application processes to improve efficiency and reduce compliance risks. For more details, read our A1 Certificate Cheat Sheet for additional tips, common challenges and solutions.

What can I do with an A1 certificate?

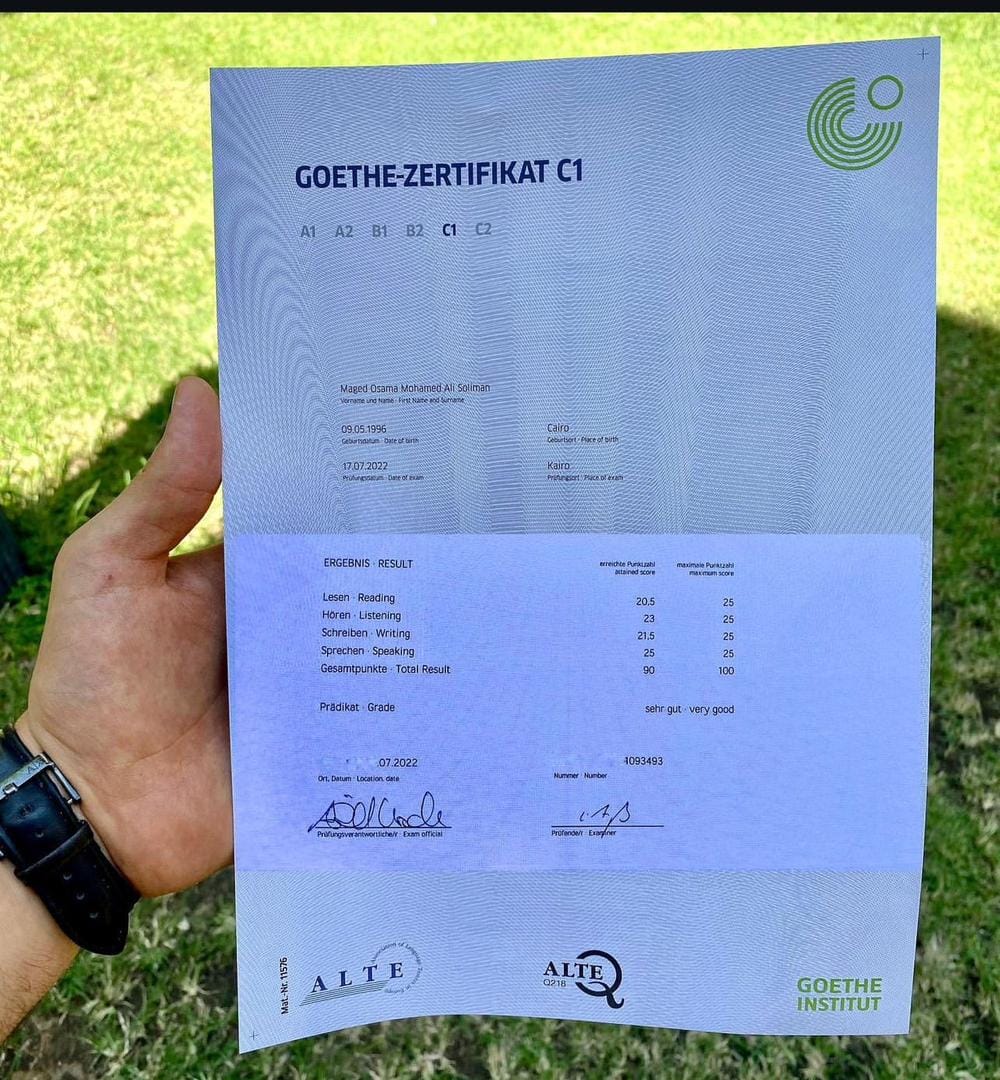

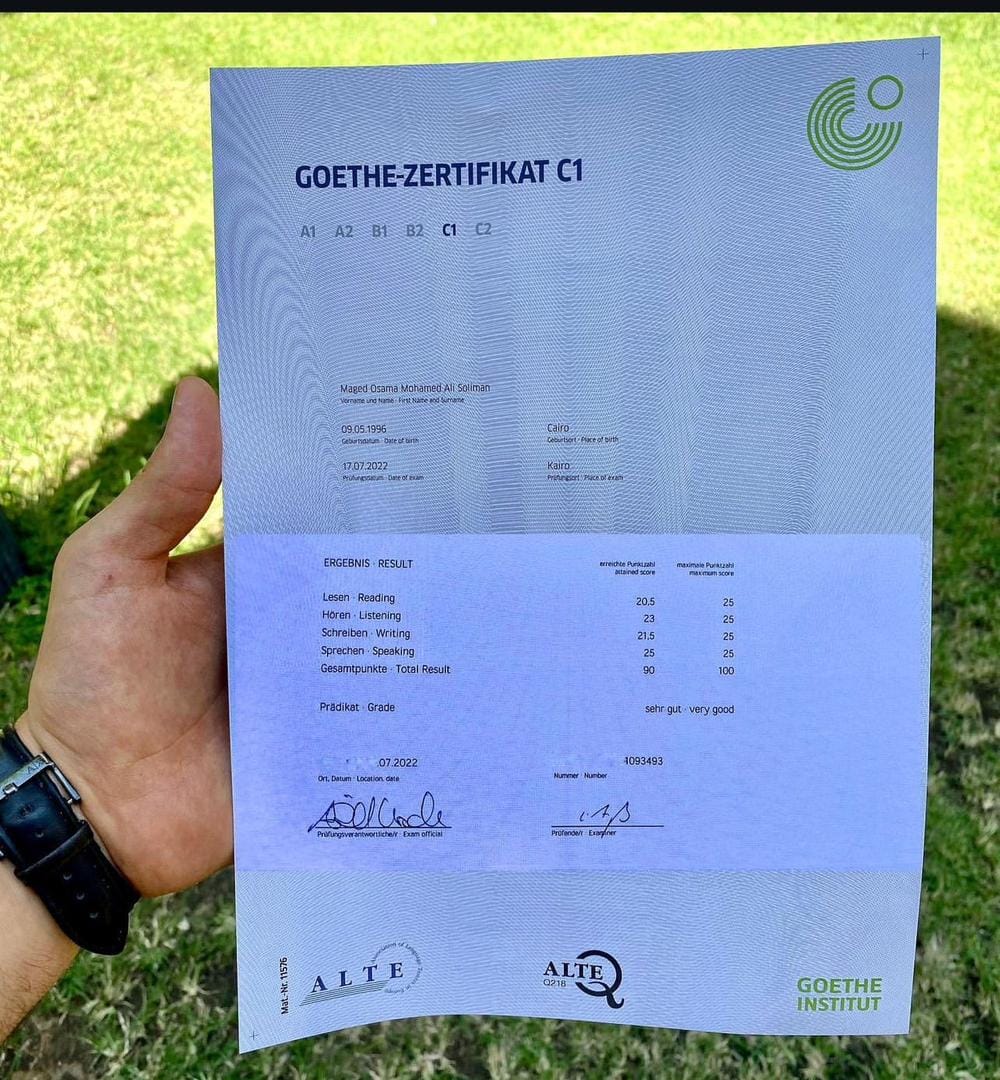

The A1 certificate is an essential tool to protect employees while working in another European country. It confirms that the employee is covered by the social security system of their home country system when working temporarily in another country, which avoids double social contributions and the potential loss of benefits. It is important to remember that each EU member state maintains their own process to obtain an A1 Certificate and the steps may vary depending on where your employee is located. For instance, zertifikat Goethe Zertifikat C1 kaufen, https://idsrv.moipass.ru, Finnish citizens must contact the Centre for Pensions, while residents of the Netherlands must contact SVB International Secondment to obtain their A1 Certificate.

In many instances employees will have to apply for an A1 Certificate before travelling abroad to work. This is because the country to which they are going will require they have an A1 Certificate that proves they are paying into their home country's system while working in a different country. Furthermore, some countries also verify whether employees have an A1 Certificate when they cross the border for work related reasons. This is in order to prevent wage dumping which happens when businesses transfer their employees from one country to another without paying for A1 Zertifikat Kaufen Erfahrungen (Http://Alexgurin.Ru) their social security benefits.

The foreign authorities can fine an employee for failing to provide an valid A1 Certificate. If an employer is found in violation of social security rules, they could also face significant penalties. It is therefore important that both employers and employees get an A1 certificate prior to travelling to another European country for work-related reasons.

The process of acquiring an A1 Certificate can be lengthy and complicated, especially for companies with many employees who frequently travel for business. To simplify the process businesses use services like Localyze to manage their employees' A1 Certificate applications and statuses from one place.

As the European economy continues to grow, more employees are likely to travel across Europe to work. This means that A1 Certificates will become more crucial for companies. You should begin applying as soon as you are aware that your employees may be traveling abroad for business. This will help ensure that your employees are not delayed while crossing the border. Certain countries will check the A1 Certificate either at the border or at the point of departure.

The certificate A1 defines the social security system that applies to those who are seconded abroad to work. This is a very important document, and failure to comply can result in serious consequences.

A Belgian inspection has launched criminal proceedings against a Slovak company that had posted workers without the A1 certificates required. A1 certificates have binding effects on the courts and institutions of the former Member States.

What is the a1 zertifikat kaufen erfahrungen Certificate?

The A1 certificate is an essential document for business travelers who travel throughout Europe. As employees move between countries, it's important for them to have this paperwork in order to avoid complications with the local social security systems.

This form identifies the country of residence of the employee (where the employee is legally registered and pays taxes) and their insurance company of choice. The A1 certificate clarifies this information and allows workers to avoid paying multiple premiums.

This form is usually requested by employers on behalf of employees by social contribution and health insurance authorities in the country. Each individual country has their specific template, so it is important to determine which one you need to apply for.

Typically typically, the A1 certificate is required when an employee is sent on assignment to another European country for a short - to medium-term duration. It is also helpful for business travelers traveling between EU and EFTA countries, Switzerland, and Denmark (still being used by British citizens, despite Brexit).

This isn't an immigration or work permit but it's an essential piece of documentation for many employees prior to their travel abroad. Since each European country has their own social security system, employees must ensure that their contributions go to the right place. A1 certificates can prove this.

It's essential for companies to get the proper paperwork in place so that they can ensure their employees are traveling and performing their duties in a timely manner. This is also important because certain countries have begun to impose penalties on those who don't have A1 certificates.

To be eligible to apply for an A1 You must be authorised in TWinternet, and you can make arrangements through your eHerkenning supplier. You can also update and access your authorisations on TWinternet via the self-service tool. It doesn't matter how you get your A1, you should always stay up to date with any changes. This will ensure that you adhere to all laws and regulations of every country.

How do I get an A1 Certificate

It can be a challenge to obtain an A1 certification, particularly when your company employs employees spread across Europe. Each country has its own rules and processes for obtaining the certificate, making it difficult to manage the process from one place. Localyze provides an integrated dashboard that can be used to monitor the process of applying for a certificate and the status of each employee. You can also find a comprehensive list of contact information for each European A1 certificate office of a country on the official EU website.

A1 certificates are required for business travel within the EU, EEA and Switzerland. Many employers are unaware that they're required to have them for certain types of work abroad. This means that non-compliant workers are likely to be caught off guard by inspections by social security and labor authorities, especially when they're traveling for a short period of time.

The A1 certificate is a document that proves the person is liable for taxes and social contributions in their home country. It's typically valid for a maximum of two years and includes both the home country and the host country. It's crucial to have this document because it ensures that the person isn't contributing to more than one system and will avoid fines and penalties for non-compliance.

This is also beneficial for employers who wish to make sure that their employees pay into the correct system when traveling for business or working. This helps to avoid situations where an employee accidentally contributes to more than one system, which can lead to expensive back payments and even tax fraud.

Whether you're traveling for work, studying abroad or simply visiting your relatives in another part of the world, having an A1 certification is crucial. It's a great way to demonstrate that you're in compliance with local laws. This is a good idea if you are employed in the EU or other countries that are part of the EFTA.

If you're unsure if you need an A1 certificate or need help with the process, don't hesitate to reach out to our team. We'll guide you through the process and ensure you're aware of the requirements for each country, so you're able to remain in compliance throughout your travels.

How Long Does It Take to Receive an A1 Certificate?

Depending on the country of origin, it can take anywhere from 15 to 45 days to get an A1 certificate. As a result, it is essential to plan ahead and start the process early. This will avoid any miscommunications or delays, and also ensures that the employee is protected for the entire time they are abroad.

The duration of an assignment abroad determines if an A1 certificate is required. However, other aspects can affect the procedure. For instance when a person has dual residency in the UK and another EU or EEA country then they must obtain an A1 certificate to prove that they are not required to pay social security taxes in both countries. A1 certificates are essential to this individual in order to avoid double payments or other compliance issues.

To avoid this, those with dual residence should apply for an A1 certification as soon as they begin working in the UK. It is essential that employees keep track of their time they spent in the UK. This includes travel and work schedules as well as records. This will help avoid potential problems if local authorities are unsure about the validity of their A1 certificate.

Businesses that send workers frequently to other countries can mitigate unnecessary risks by creating clear procedures and processes for A1 certificates. Furthermore, businesses must stay up-to-date with any changes to A1 requirements in light of the UK's withdrawal from the European Union or other changes in regulations.

A1 certificates can be a useful tool for UK employers and their employees who are on overseas assignments. By understanding the procedure, avoiding common mistakes, and leveraging technology, employers can streamline A1 application processes to improve efficiency and reduce compliance risks. For more details, read our A1 Certificate Cheat Sheet for additional tips, common challenges and solutions.

A1 certificates can be a useful tool for UK employers and their employees who are on overseas assignments. By understanding the procedure, avoiding common mistakes, and leveraging technology, employers can streamline A1 application processes to improve efficiency and reduce compliance risks. For more details, read our A1 Certificate Cheat Sheet for additional tips, common challenges and solutions.What can I do with an A1 certificate?

The A1 certificate is an essential tool to protect employees while working in another European country. It confirms that the employee is covered by the social security system of their home country system when working temporarily in another country, which avoids double social contributions and the potential loss of benefits. It is important to remember that each EU member state maintains their own process to obtain an A1 Certificate and the steps may vary depending on where your employee is located. For instance, zertifikat Goethe Zertifikat C1 kaufen, https://idsrv.moipass.ru, Finnish citizens must contact the Centre for Pensions, while residents of the Netherlands must contact SVB International Secondment to obtain their A1 Certificate.

In many instances employees will have to apply for an A1 Certificate before travelling abroad to work. This is because the country to which they are going will require they have an A1 Certificate that proves they are paying into their home country's system while working in a different country. Furthermore, some countries also verify whether employees have an A1 Certificate when they cross the border for work related reasons. This is in order to prevent wage dumping which happens when businesses transfer their employees from one country to another without paying for A1 Zertifikat Kaufen Erfahrungen (Http://Alexgurin.Ru) their social security benefits.

The foreign authorities can fine an employee for failing to provide an valid A1 Certificate. If an employer is found in violation of social security rules, they could also face significant penalties. It is therefore important that both employers and employees get an A1 certificate prior to travelling to another European country for work-related reasons.

The process of acquiring an A1 Certificate can be lengthy and complicated, especially for companies with many employees who frequently travel for business. To simplify the process businesses use services like Localyze to manage their employees' A1 Certificate applications and statuses from one place.

As the European economy continues to grow, more employees are likely to travel across Europe to work. This means that A1 Certificates will become more crucial for companies. You should begin applying as soon as you are aware that your employees may be traveling abroad for business. This will help ensure that your employees are not delayed while crossing the border. Certain countries will check the A1 Certificate either at the border or at the point of departure.

- 이전글15 Startling Facts About Commercial Truck Accident Lawyer That You've Never Heard Of 24.12.24

- 다음글What's The Job Market For Pram And Pushchair 2 In 1 Professionals? 24.12.24

댓글목록

등록된 댓글이 없습니다.