"Getting a Loan for Bad Credit - What You Need to Know"

페이지 정보

본문

Subtitle 1: What Counts as Bad Credit?

When it comes to getting a mortgage for poor credit, the primary query is commonly, "What counts as unhealthy credit?" The reply just isn't a easy one, as there are several variables that may come into play. Generally, a credit score rating of 580 or under is taken into account poor credit by most lenders. This can be due to a wide selection of reasons, such as having a high debt-to-income ratio, having missed funds, or having too many open accounts.

Subtitle 2: How to Get a Loan for Bad Credit

Subtitle 2: How to Get a Loan for Bad Credit

Despite having unfavorable credit ratings, there are still choices out there to you. The first step is to understand what kind of loan you're on the lookout for. Some of the commonest forms of loans for poor credit include secured loans, corresponding to auto loans and Pretheure.Com mortgages, or unsecured loans, similar to private loans and bank cards.

Once you may have identified the sort of mortgage you want, the following step is to shop around for lenders who offer loans for poor credit. Be certain to match interest rates, fees, loan phrases, and compensation plans to find the best deal for you.

It is also important to listen to any fees or penalties associated with bad credit loans. Be sure to read the fantastic print and ask questions before signing any mortgage paperwork.

Subtitle three: What to Do if You Can’t Get a Loan for Bad Credit

If you find that you're unable to get a mortgage for poor credit, there are nonetheless options obtainable to you. The first is to assume about a mortgage cosigner. A cosigner is somebody who agrees to tackle the responsibility of paying back the loan if you're unable to.

Another option is to start rebuilding your credit score. This can be accomplished by making on-time funds, decreasing your debt, and having an excellent payment historical past. Once you might have improved your credit score rating, you may have the ability to qualify for a mortgage later down the road.

Subtitle four: Final Thoughts

Getting a loan for poor credit could be a challenge, however it isn't inconceivable. By understanding what counts as poor credit and shopping around for one of the best deal, you'll find the loan that works for you. It is also important to concentrate to any charges or penalties associated with bad credit loans, and to consider a mortgage cosigner or rebuilding your credit score if you are unable to get a loan.

When it comes to getting a mortgage for poor credit, the primary query is commonly, "What counts as unhealthy credit?" The reply just isn't a easy one, as there are several variables that may come into play. Generally, a credit score rating of 580 or under is taken into account poor credit by most lenders. This can be due to a wide selection of reasons, such as having a high debt-to-income ratio, having missed funds, or having too many open accounts.

Subtitle 2: How to Get a Loan for Bad Credit

Subtitle 2: How to Get a Loan for Bad CreditDespite having unfavorable credit ratings, there are still choices out there to you. The first step is to understand what kind of loan you're on the lookout for. Some of the commonest forms of loans for poor credit include secured loans, corresponding to auto loans and Pretheure.Com mortgages, or unsecured loans, similar to private loans and bank cards.

Once you may have identified the sort of mortgage you want, the following step is to shop around for lenders who offer loans for poor credit. Be certain to match interest rates, fees, loan phrases, and compensation plans to find the best deal for you.

It is also important to listen to any fees or penalties associated with bad credit loans. Be sure to read the fantastic print and ask questions before signing any mortgage paperwork.

Subtitle three: What to Do if You Can’t Get a Loan for Bad Credit

If you find that you're unable to get a mortgage for poor credit, there are nonetheless options obtainable to you. The first is to assume about a mortgage cosigner. A cosigner is somebody who agrees to tackle the responsibility of paying back the loan if you're unable to.

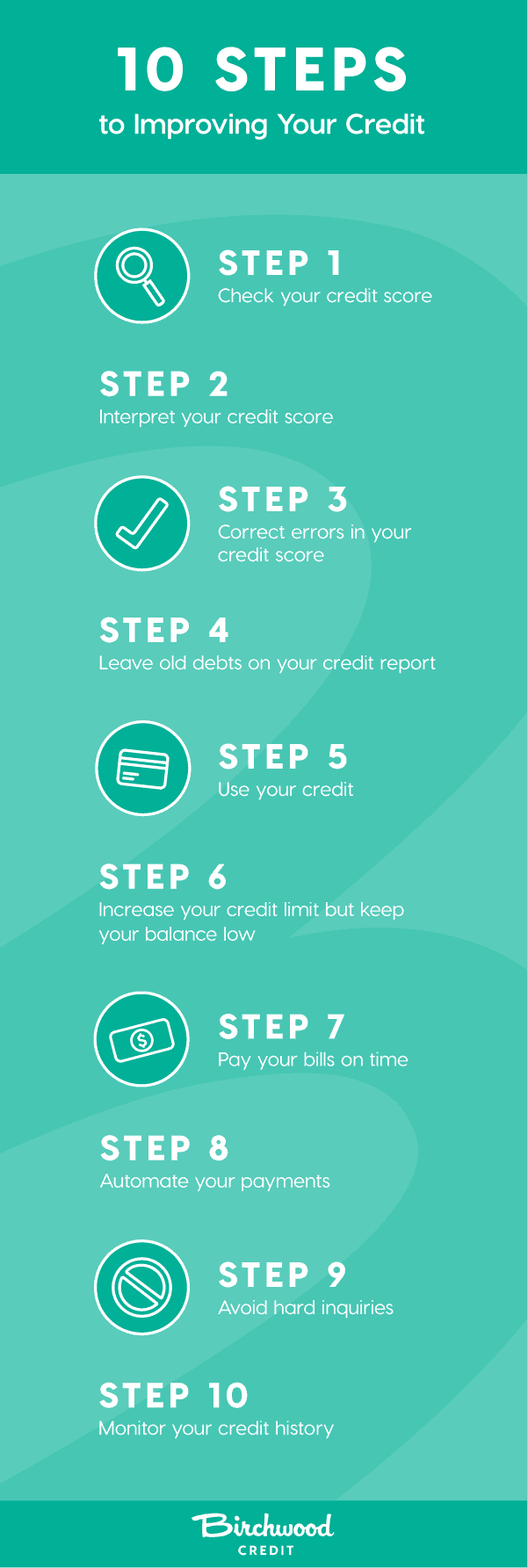

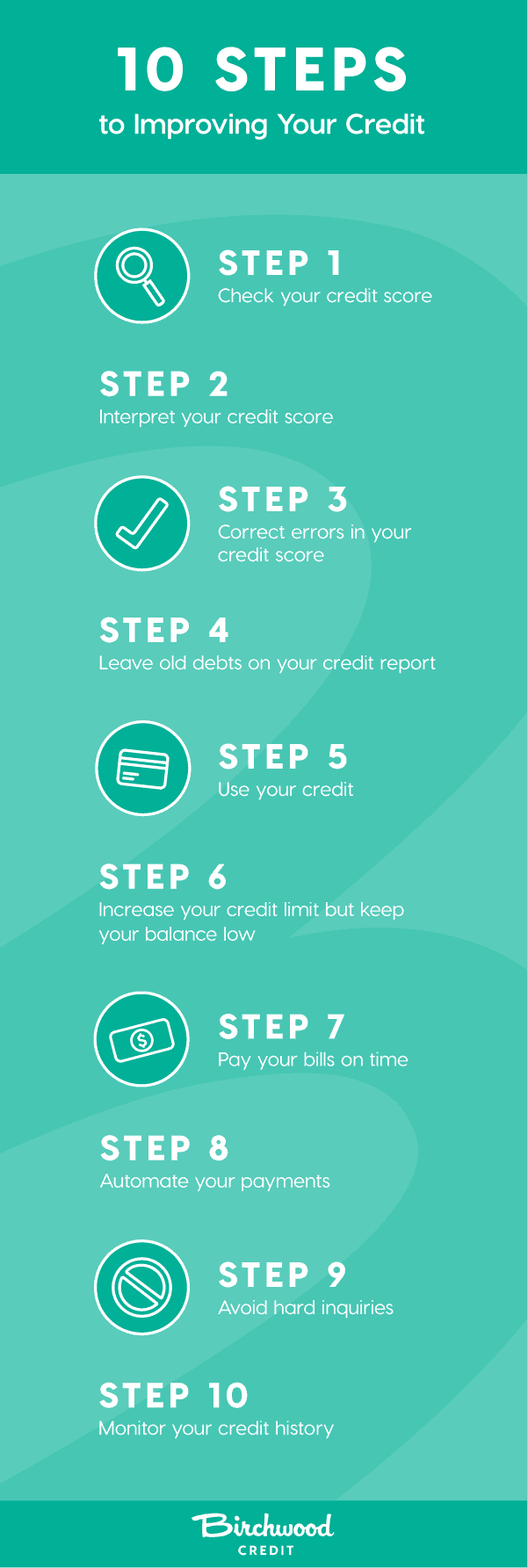

Another option is to start rebuilding your credit score. This can be accomplished by making on-time funds, decreasing your debt, and having an excellent payment historical past. Once you might have improved your credit score rating, you may have the ability to qualify for a mortgage later down the road.

Subtitle four: Final Thoughts

Getting a loan for poor credit could be a challenge, however it isn't inconceivable. By understanding what counts as poor credit and shopping around for one of the best deal, you'll find the loan that works for you. It is also important to concentrate to any charges or penalties associated with bad credit loans, and to consider a mortgage cosigner or rebuilding your credit score if you are unable to get a loan.

- 이전글15 Secretly Funny People Working In Samsung Fridge 24.12.22

- 다음글Five Laws That Will Aid Those In Pragmatic Site Industry 24.12.22

댓글목록

등록된 댓글이 없습니다.